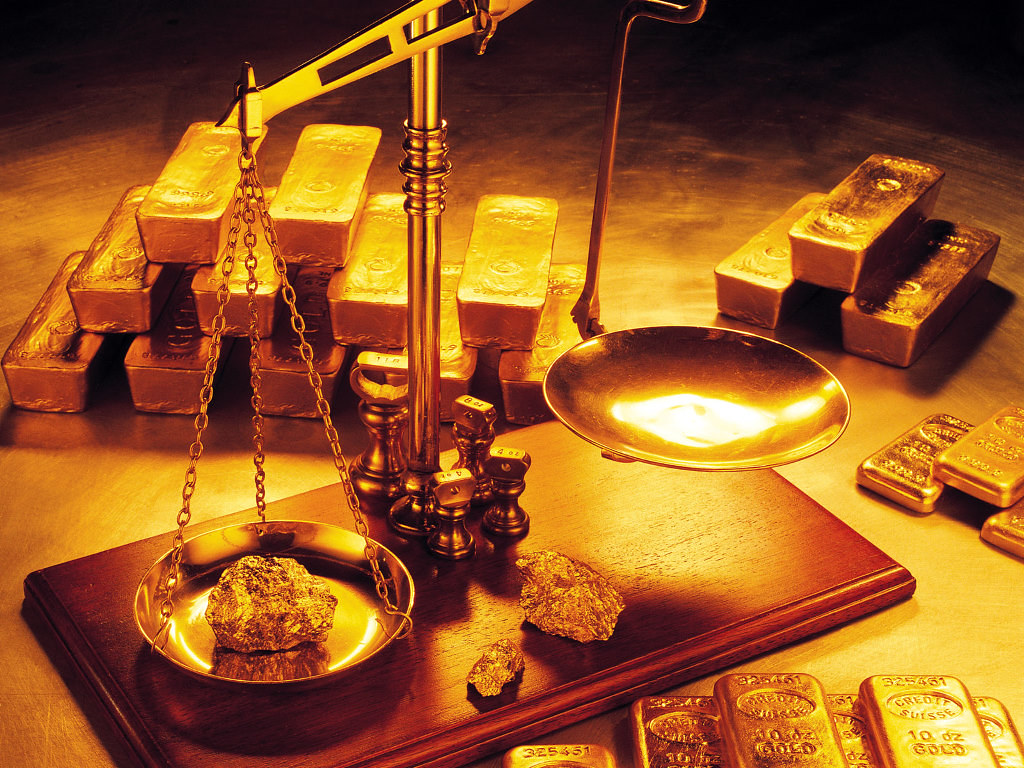

Gold reached an all-time high in 2025, rising 53% to surpass $4,000 per ounce. According to experts, this rise is driven by geopolitical tensions and economic uncertainties around the world — and it doesn’t seem likely to stop anytime soon.

Wars and trade tensions trigger a search for safety

The Russia-Ukraine war, the conflict in Gaza, and airstrikes extending to Iran and Yemen have accelerated investors’ turn to gold as a “safe haven.” At the same time, Donald Trump’s trade tariffs have shaken the global trade balance, deepening concerns about the US economy and the strength of the dollar.In September alone, there was a 12% jump in just one month; This increase also pushed up the prices of silver, platinum and palladium.

“This kind of rally tells us something is wrong,” says Commodity Market Analytics director Dan Smith.

Central banks are also rushing to gold

Low interest rate policies and limited interest rate increases are driving investors to gold This has led to viewing gold as a store of value. Central banks are moving their reserves away from the dollar by purchasing approximately 1,000 tons of gold by 2025. This marks the fourth consecutive year of major buying.

Is a new “bull market” beginning?

Although the risk of selling increases after each rise, analysts believe that exceeding the $4,000 threshold could open the door to a new uptrend that could last until 2026.

“Every factor affecting gold prices today is at play simultaneously,” he says. BNP Paribas analyst David Wilson said, “Investors are now trusting gold, not US bonds.”

Increased inflows into physical gold funds and bullion demand in recent weeks are also supporting the rise.

Goldman Sachs raised its gold price forecast for December 2026 to $4,900 per ounce.“A turnaround seems difficult”

“Perhaps there won’t be a decline this time,” says Wilson. “Without a sudden change in U.S. trade or immigration policies, it’s difficult to expect optimism in the global outlook.”